Which of the following statements about flood insurance is true: Flood insurance is a crucial safeguard against the devastating financial consequences of flooding, providing peace of mind and security to homeowners and businesses. Understanding its coverage and benefits is essential for mitigating flood risks and ensuring financial stability.

In this comprehensive guide, we delve into the intricacies of flood insurance, exploring its purpose, types of coverage, eligibility criteria, and limitations. We also examine alternative risk management strategies and share real-life case studies to empower you with the knowledge and insights necessary to make informed decisions regarding flood insurance.

1. Definition of Flood Insurance

Flood insurance is a type of insurance that provides financial protection against damages caused by flooding. It covers the costs of repairing or replacing damaged property, as well as the loss of income or business interruption caused by a flood.

Flood insurance is typically purchased by homeowners and businesses located in areas that are at risk of flooding, such as coastal areas, river basins, and floodplains.

Types of Properties Covered by Flood Insurance, Which of the following statements about flood insurance is true

- Residential properties, including single-family homes, multi-family homes, and mobile homes

- Commercial properties, such as offices, retail stores, and industrial buildings

- Non-residential properties, such as schools, churches, and hospitals

2. Importance of Flood Insurance

Prevalence of Flooding and its Potential Impact

Flooding is a common and devastating natural disaster. According to the National Flood Insurance Program (NFIP), over 25% of all flood insurance claims come from areas that are not considered high-risk flood zones.

Flooding can cause extensive damage to property, including structural damage, water damage, and mold growth. It can also lead to loss of income, business interruption, and displacement of residents.

Financial Risks Associated with Flooding

The financial costs of flooding can be significant. The average flood insurance claim is over $40,000, and some claims can exceed $100,000.

Without flood insurance, homeowners and businesses are responsible for paying the costs of flood damage out of pocket. This can lead to financial hardship, especially for those who are already struggling financially.

How Flood Insurance Can Protect Homeowners and Businesses

Flood insurance provides financial protection against the costs of flood damage. It can help homeowners and businesses to:

- Repair or replace damaged property

- Cover the costs of temporary housing or business interruption

- Protect their financial assets from the devastating effects of flooding

3. Requirements for Flood Insurance

Eligibility Criteria

To be eligible for flood insurance, a property must be located in an area that is designated as a Special Flood Hazard Area (SFHA) by the Federal Emergency Management Agency (FEMA).

In addition, the property must be:

- A residential building with one to four units

- A commercial building

- A non-residential building

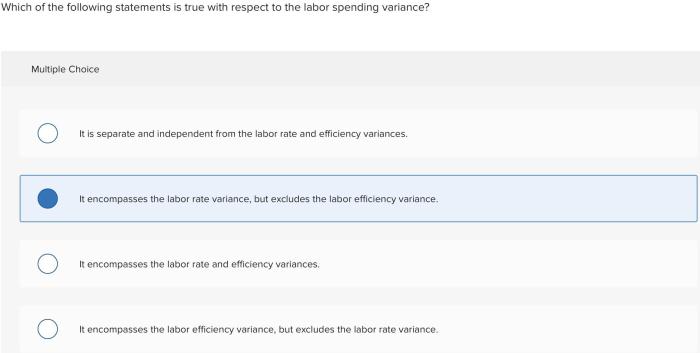

Purchasing Flood Insurance

Flood insurance can be purchased through the NFIP or through private insurance companies.

The cost of flood insurance varies depending on the risk of flooding in the area where the property is located. The deductible is typically 1% of the coverage amount.

Mandatory Requirements for Flood Insurance

In some areas, flood insurance is mandatory for properties that are located in SFHAs. This is typically the case for properties that are financed with a federally backed mortgage.

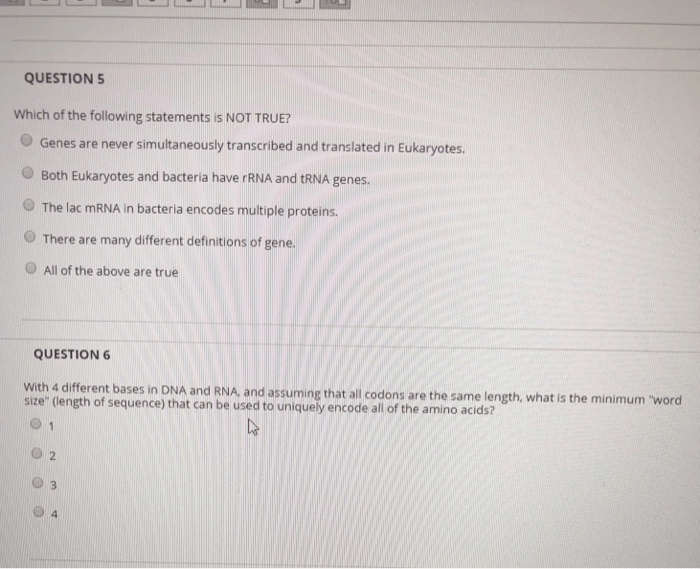

Expert Answers: Which Of The Following Statements About Flood Insurance Is True

Is flood insurance mandatory?

Flood insurance may be mandatory in certain areas designated as high-risk flood zones by the Federal Emergency Management Agency (FEMA).

What types of properties are covered by flood insurance?

Flood insurance typically covers single-family homes, multi-family dwellings, businesses, and other structures.

What does flood insurance cover?

Flood insurance covers direct physical damage to insured property caused by flooding, including the cost of repairs, replacement, and loss of income.